santa clara property tax rate

For Santa Clara County the rate is 055 per every 500. The average effective property tax rate in Santa Clara County is 073.

Santa Clara County Property Tax Tax Assessor And Collector

Should you be currently living here.

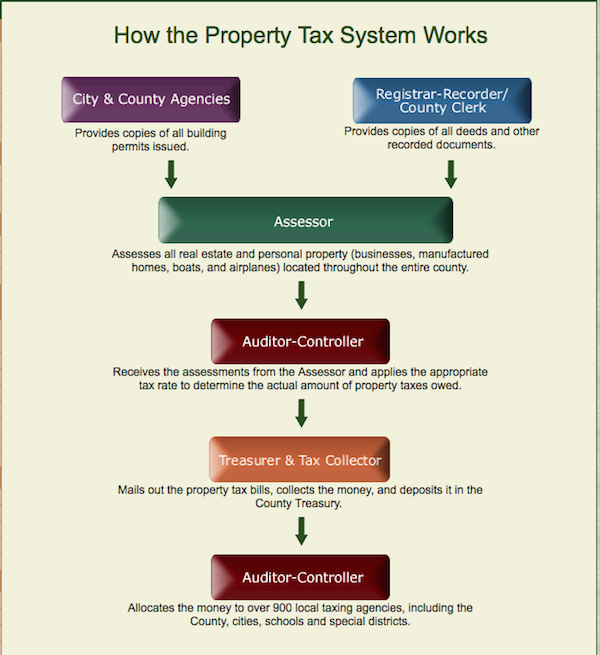

. The Assessor is responsible for establishing assessed values used in calculating property taxes and maintaining ownership and address information. The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations. Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax.

The average effective property tax rate in Santa Clara County is 073. East Wing 6th Floor. San Jose CA 95110-1767.

For comparison the median home value in Santa Clara County is. Learn all about Town Of Santa Clara real estate tax. Whether you are already a resident or just considering moving to Town Of Santa Clara to live or invest in real estate estimate local.

Tax rates can be complicated even without a. Other Taxes and Fees There will also be a transfer tax based on the value of the property and the rate will vary throughout California. The bills will be available online to be viewedpaid on the same day.

The median property tax in Santa Clara County California is. Sales and use taxes in California Wikipedia. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Yearly median tax in Santa Clara County. 2015 SANTA CLARA COUNTY SALES TAX RATE Â TAXES.

Santa Clara County collects on average 067 of a propertys. The bills will be available online to be viewedpaid on the same day. Every entity establishes its individual tax rate.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Yearly median tax in Santa Clara County. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate.

With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. Santa Clara County California Property Taxes Tax Rates org.

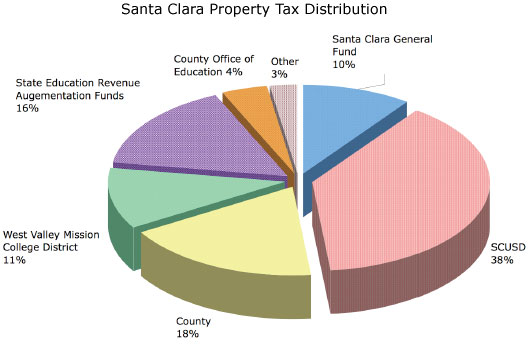

Collections are then disbursed to related taxing units per an allocation agreement. 104 W 113th St New York NY 10026. The budgettax rate-setting process typically.

The median property tax in Santa Clara County California is. Use the courtesy envelope provided and return the appropriate stub. The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000.

Department of Tax and Collections. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. The bills will be available online to be viewedpaid on the same day.

There are three primary phases in taxing real estate ie devising levy rates appraising property market worth. Search the owner of your interest create a free account and. The Controller-Treasurers Property Tax.

Property Assessments Reach 551 5 Billion Peak Of Santa Clara County Economic Growth San Jose Spotlight

By Santa Clara County Controller Treasurer S Office Ppt Download

City S General Fund Gets Small Share Of Santa Clara Property Tax Dollars The Silicon Valley Voice

Santa Clara County California Ballot Measures Ballotpedia

Santa Clara County Property Taxes Due Date Ke Andrews

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

By Santa Clara County Controller Treasurer S Office Ppt Download

Property Tax Calculator Smartasset

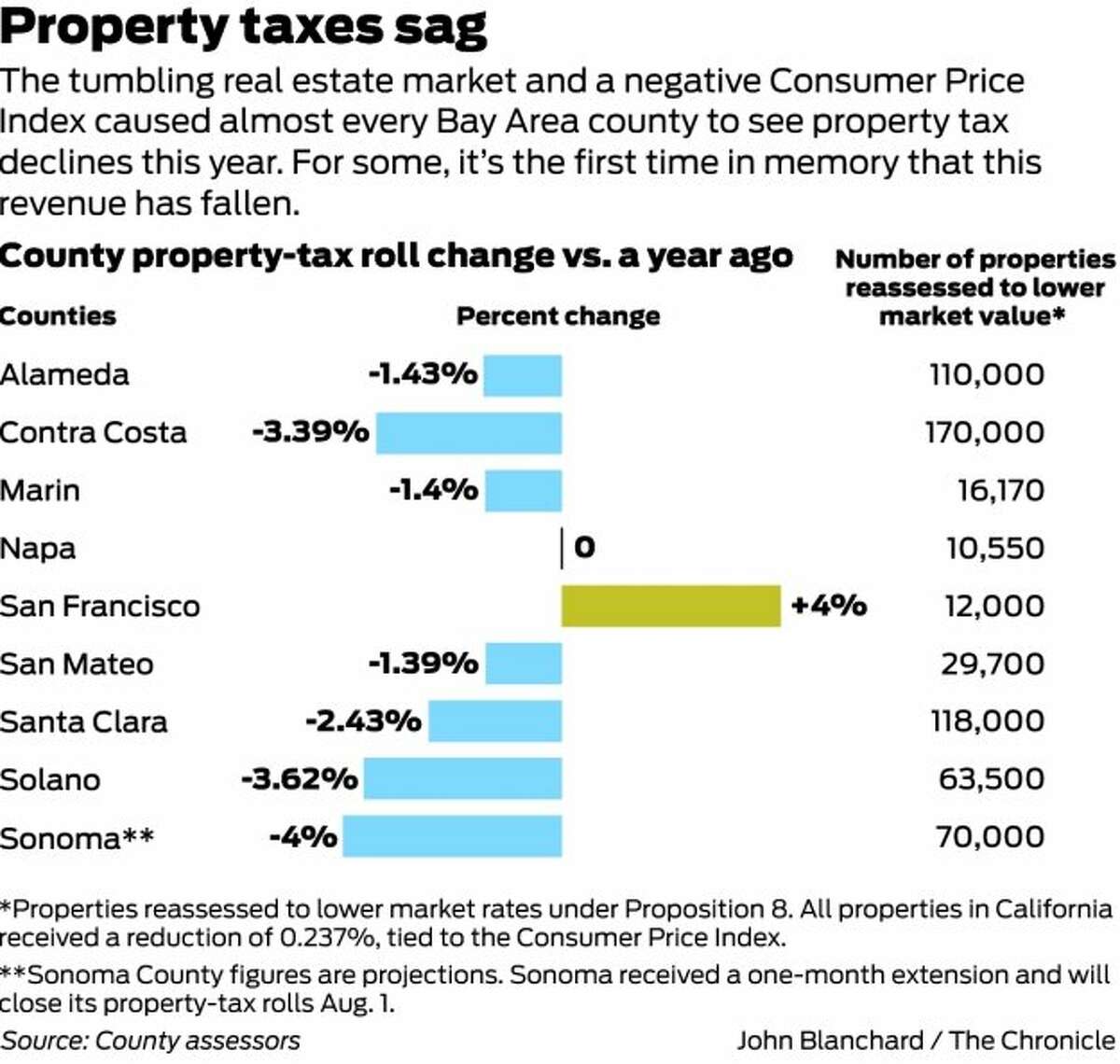

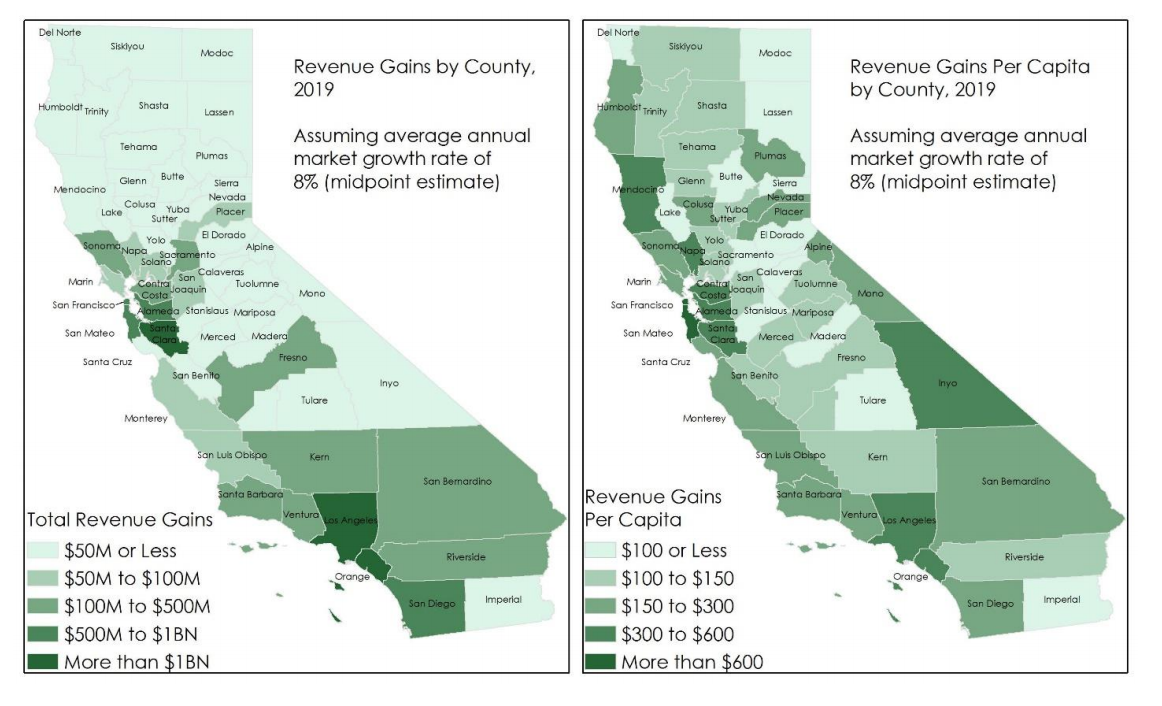

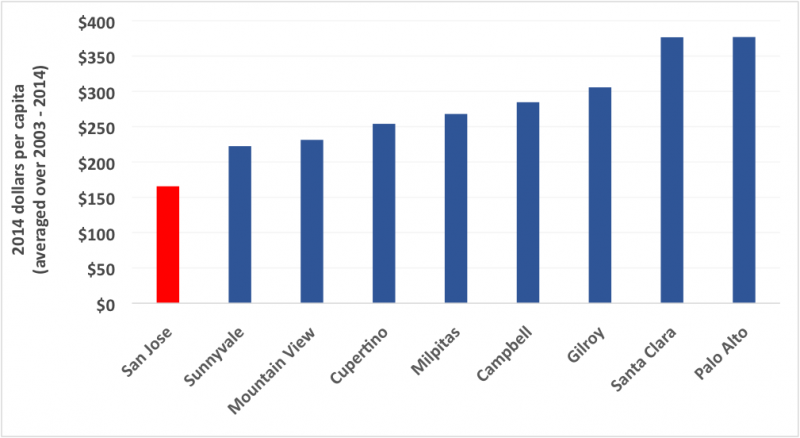

Strengthening The Budget Of The Bay Area S Largest City Spur

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

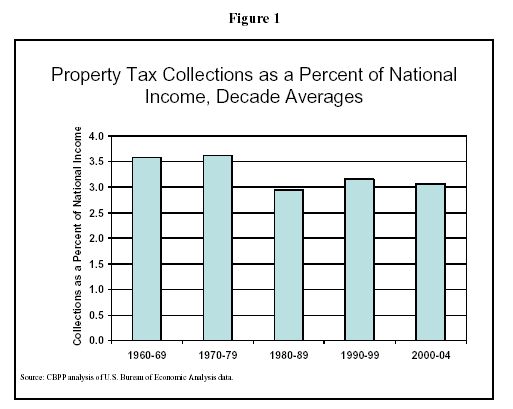

Property Taxes In Perspective Center On Budget And Policy Priorities

Understanding California S Property Taxes

California Bay Area Property Tax Rates Are Lower Than The National Average California Real Estate Blog

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

California Sales Tax Rate By County R Bayarea

Los Angeles Property Tax Which Cities Pay The Least And The Most